REGULUS THERAPEUTICS INC.

10628 Science Center Drive,4224 Campus Point Court, Suite 225210

San Diego, California 92121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On August 1, 2019June 14, 2021

Dear Stockholder:

You are cordially invited to attend the 20192021 Annual Meeting of Stockholders of Regulus Therapeutics Inc., a Delaware corporation (the “Company”). The meeting will be held on August 1, 2019June 14, 2021 at 9:00 a.m. local time at the Company’s principal executive offices located at 10628 Science Center Drive,4224 Campus Point Court, Suite 225,210, San Diego, CA 92121 for the following purposes:

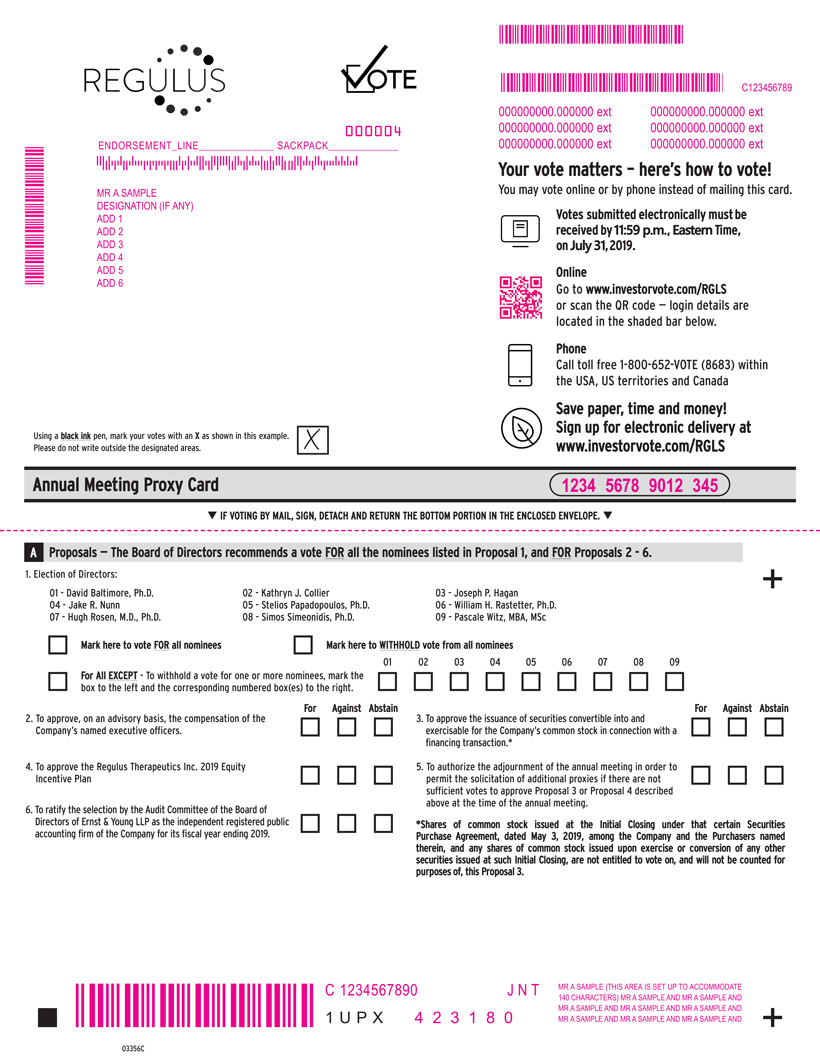

| 1. | To elect the |

| 2. | To approve an amendment to our Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 200,000,000 to 400,000,000; |

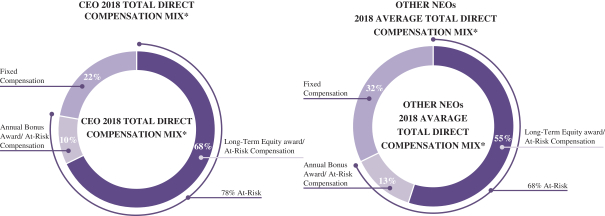

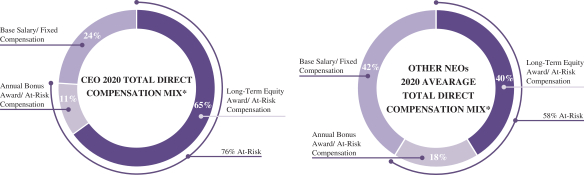

| 3. | To approve, on an advisory basis, the compensation of the Company’s named executive officers; |

|

| 4. |

|

|

To ratify the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending |

To approve the authorization to adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal 2. |

| 6. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this notice.

In light of the ongoing COVID-19 pandemic and applicable government guidelines, we are planning for the possibility that the annual meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance in a press release and details on how to participate will be available at http://ir.regulusrx.com/financial-information/annual-reports as soon as practicable before the annual meeting.

The record date for the annual meeting is June 28, 2019.April 16, 2021. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on August 1, 2019 at the Company’s principal offices located at 10628 Science Center Drive, Suite 225, San Diego, CA 92121.

The proxy statement and annual report to stockholders

are available at http://ir.regulusrx.com/financial-information/annual-reports

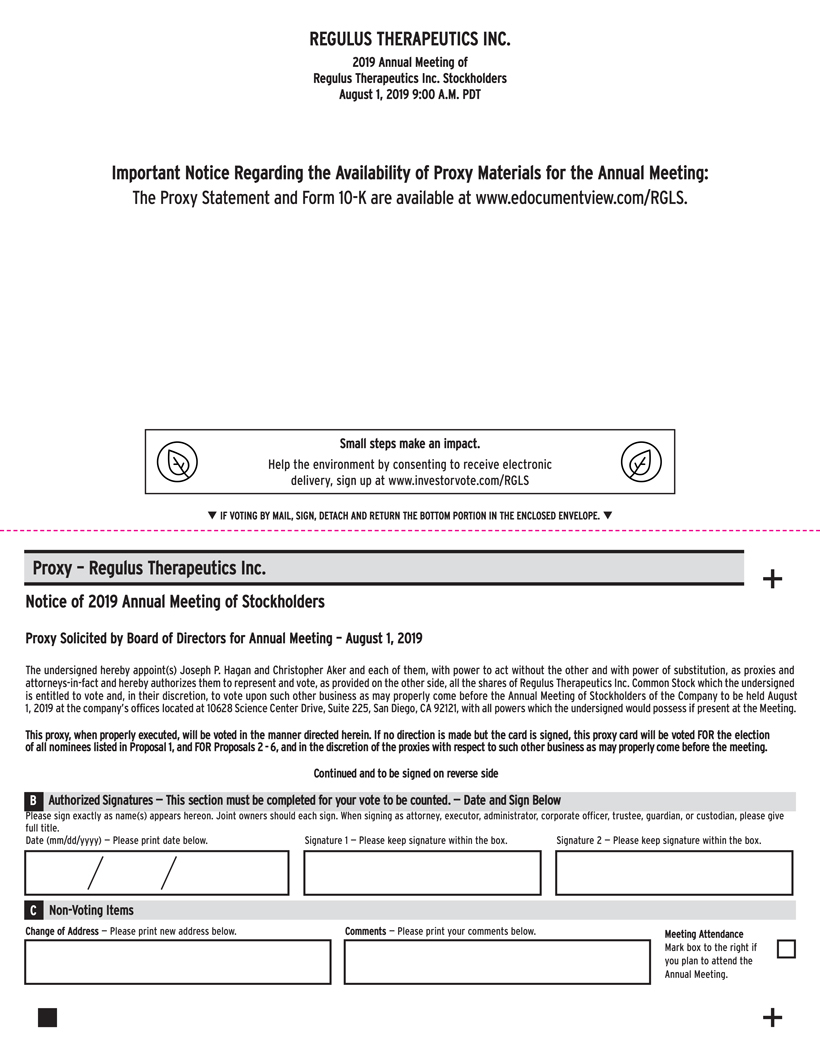

By Order of the Board of Directors

Christopher Aker

Corporate Secretary

San Diego, California

July 1, 2019April 30, 2021

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy card that may be mailed to you or vote by telephone or through the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.